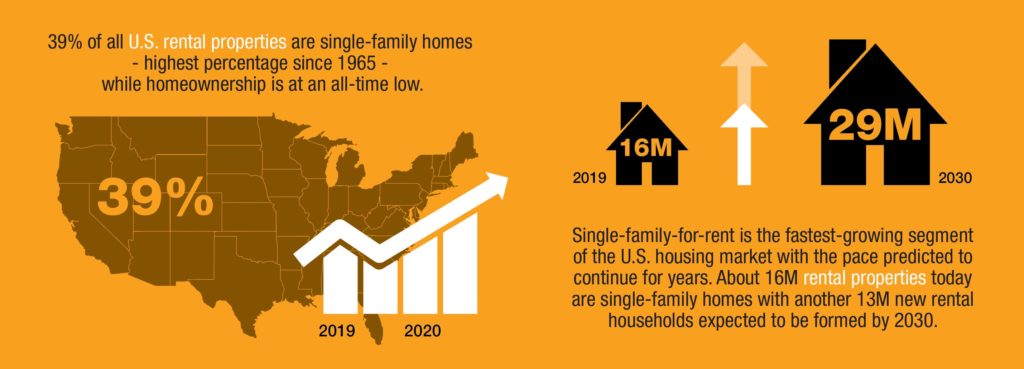

The single-family home market is changing. There’s a shift in ownership underway… as well as an evolution in the profile of a large audience of typical residents. And building product brands can position themselves for this lucrative, increasing trajectory.

A historical journey provides us with some perspective. Following a wave of mortgage foreclosures set off by the 2008 financial crisis, investors started buying large numbers of single-family homes. And, in the years since, rental home ownership has grown into a full-fledged asset class as investment firms and public funds have accelerated the momentum of this opportunity.

Investors are now targeting a specialized group of developers to build for-rent homes — that look like other suburban housing — in single-family developments and then marketing those homes directly to renters, instead of potential owners.

Shifting market factors

Build-for-rent (BFR) is an emerging growth trend. And its importance should not be ignored. After all, a host of important demographic and economic conditions are aligning… to inspire the channel’s focus on this increasing opportunity.

Consider, for example, that the median sales price of a single-family home continues to increase dramatically. From mid-2019 until June 2021, the median sales price of a home grew from $300,000 to $341,000.

A traditional 20% down payment is $68,220… which equates to a year’s salary for the median income in the U.S.

Yet, the average household savings in America is only $17,135. And, significantly, 69% of adult Americans have less than $1,000 in a savings account.

A diverse target audience

Millennials and Generation Z are two important demographic groups driving a growing demand for entry-level housing. Yet, increased levels of student and other debt — combined with high housing prices — put homeownership out of reach for many in these age groups. Even in a two-income household… it’s difficult for this generation to save the down payment required for a home purchase.

In fact, 43% of this age group have saved less than $3,000 for a down payment, according to a Unison Home Buyer Survey. Although 92% of millennials consider homeownership a good investment, 48% of young adults say they will delay buying a home because of their debt loads. And many are still assessing their career, as they work to establish and stabilize their lives… making homeownership impractical. Or even fiscally impossible.

What’s more, the increased availability of remote work has caused many Millennials — a number of whom are preparing to start a family — to consider flexible options that allow them to “try out” different locations. While avoiding the responsibilities… that typically come with being a homeowner.

So, instead of seeking to qualify for and buying a house, the next best opportunity is to rent a single-family home. Renters may still enjoy yard work, but — for those who don’t — landscaping along with the structure’s general maintenance is included in this type of property’s management. And a resident can quickly move on when desired… without the obligations that often accompany selling their current residence.

Even though Millennials and Gen Z-ers get most of the press attention when it comes to BFR, it’s not just younger audiences who are renters. The number of people renting homes is increasing — as a percentage of the population — faster than the percentage who own a home. And the residents in that rental cohort come from across a wide variety of demographic groups, ages, and income levels.

Interestingly, during the last twenty years, many Baby Boomers are opting for shorter-term living arrangements in the rental market in lieu of homeownership. And why not? Many are seeking fewer responsibilities. And the flexibility to be mobile as they age. Surprisingly, the growth in renters aged 55 and older since 2010 is more than 10 times higher than for other age groups.

Trends within the trend

As the number of home renters increases — and as the popularity of BFR continues to grow — several “micro trends” are worth noting and watching.

- 36% of all U.S. households are renters.

- There is a movement toward larger BFR projects.

- Smaller metros are experiencing the most activity.

- The single family rental occupancy rate is 98% nationally.

- Year-over-year retention rates are high — ranging between 55 and 60%.

- Rent-per-square-foot for single-family rentals is increasing.

The BFR communities now appearing in markets such as Phoenix, Nashville, Houston and Orlando feature higher rents and more amenities than typically would be found in a suburban apartment community. It’s clear that the developers of these communities are seeking to attract a different market.

A winning proposition

From a renter’s perspective, rental communities can act as a relief valve in a time of scarce affordable housing. After more than a year of living with the pandemic, more and more people who have the option of remote work are leaving crowded cities and moving to “sister cities”. As well as to more rural areas.

Notably, with more people continuing to work from home, the ability to have a separate home office becomes more important. And, as families continue to spend more time at home, a rental home typically offers more room than an apartment… along with much desired outdoor living and entertaining spaces.

Fact is, BFR communities offer more space inside — as well as outside — and do so without the need for a substantial upfront payment. For many audiences, young and old, BFR fits their needs at prices they can accommodate.

From a builder and developer’s perspective, selling homes typically involves offering the buyer a range of choices of colors, materials, and finishes… designed to personalize their home. This costly and time-consuming process is not needed when building homes for rent.

Rather, BFR communities introduce a level of mass-standardization not typically found in single-family home construction. So, builders can use similar products, surfaces, and accents throughout a subdivision rather than offering more custom options. As result, the need for “change orders” is eliminated. Builds are faster. And fewer mistakes occur in the field — increasing job site efficiencies.

From an investor’s perspective, the payoff starts when the community is open and when tenants move in. Not when individual units are sold. The investment continues to pay off month by month. Instead of a single time, as with the typical homeownership model.

Now that many lenders (including Freddie Mac and Fannie Mae — who underwrote a 10-year, $1 billion loan for the largest single-family rental operator in the U.S. — have underwritten and approved this product type for loans, the investor community is poised to expect more consistency on debt terms. And to more easily model… a long-term hold period.

From a building product manufacturer’s perspective, the BFR building trend offers tremendous opportunities for bulk sales. And pre-assembled, component systems. Many identical, freestanding homes mean larger orders. Logistics are simplified, and these systems and assemblies are easier to fulfill and ship. In addition, more builders and investors are paying attention to the growing desire for smart, inter-connected home appliances. And products that contribute to healthy living spaces.

The BFR model is a winning prospect for all parties. And progressive building product brands are taking notice. Scaling up production to meet larger orders to increase overall profit… as the resulting per-unit cost drops. Additionally, products are “field-tested” over multiple applications — and, as such, are less likely to fail, reducing the potential for warranty claims.

And repairing disrupted “just in time” supply chains which now can better adapt to a more modern “just in case” model. What’s not to love?

Growing momentum

BFR is a growing phenomenon that is meeting the need for an evolved construction philosophy amid an increasing housing shortage. It offers the dream of a suburban home with a yard — and a garage — to an entire group of residents who would otherwise be challenged to afford it. At the same time, this shift is attracting large capital investments and some of the best-known home builders in the country… such as Lennar, Toll Brothers, KB Home, and many others.

Is build-for-rent here to stay?

With demographics shifts, the desire for increased mobility, and the opportunity for the home and building products industry to get more “feet in the door,” this trend likely will continue to gain traction.

If you’re looking for a strategic marketing partner to help your building product brand take advantage of the many opportunities arising from the burgeoning build-for-rent trend, send an email to Steve Kleber at sk@kleberandassoicates.com.