The United States’ two home improvement retail behemoths, The Home Depot and Lowe’s, announced their third quarter earnings this week and they were eye-opening. We’ll analyze how to leverage this new “big box” trending data — to help you drive sales and marketing best practice — for use in 2022 planning… even if you are prioritizing two-step distribution.

Despite supply chain challenges and labor shortages, these two companies are making more money than ever. And the lessons to be learned are a result of successful execution… not merely extensions of the red-hot real estate market. Based on our own client projections — and these reports — we confidently expect good times will continue.

It turns out these sales weren’t just fueled by people who wanted to paint their living rooms or plant a kitchen garden… bored from an extended lock down. Increasingly, both The Home Depot and Lowe’s are selling to contractors and other building professionals. In fact, based upon the reporting this week, some 45 percent of The Home Depot’s total sales come from pro customers. Both companies have invested heavily in their distribution networks and The Home Depot, in particular, is clearly directing more of its marketing efforts to larger builders.

The rate of growth for sales to professionals — as opposed to consumers — is increasing faster for both stores. Consider that, in The Home Depot’s case, their pro-business outpaced the DIY side… for the first time ever in Q1 2021. At Lowe’s, growth of pro sales also surpassed DIY sales in the first quarter… with gains of more than 30 percent year over year.

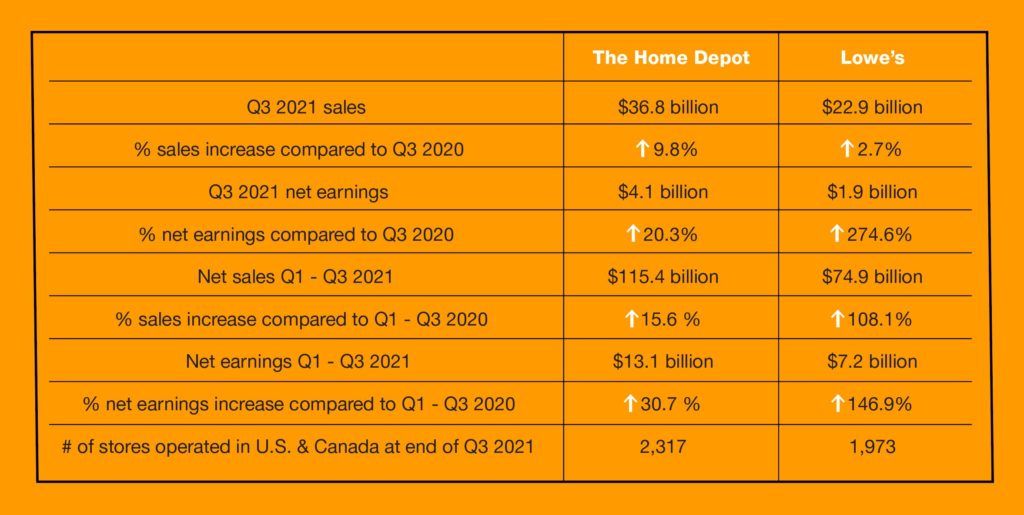

The Home Depot reported sales of $36.8 billion for Q3 2021, a year over year increase of 9.8 percent from the third quarter of 2020. Their net earnings for Q3 2021 were $4.1 billion, a 20.3 percent increase compared with net earnings of $3.4 billion in the same period of 2020.

Lowe’s, on the other hand, reported sales of $22.9 billion for Q3 2021, a 2.7 percent increase year over year when compared to the third quarter of 2020. Their net earnings were $1.9 billion in Q3 2021, a 274.6 percent increase compared to net earnings of $692 million from the same period in 2020.

The digital connection

Home improvement big box retailers are experiencing explosive growth fueled in part by their web and social traffic. And building professionals are spending a growing amount of time online. Since online activity fuels sales, it is now more important than ever before that building product brands have a robust social media presence.

We’ve written before about how successful the embrace of e-commerce has been for both companies. They practically invented the whole “click and collect” model during the early days of the pandemic… and their respective web traffic remains impressive.

In October alone, The Home Depot attracted 185 million website visitors while Lowe’s drew 116 million visitors to its site. Each brand drives web traffic through a combination of organic search, paid search, referrals and social media.

As far as social goes, The Home Depot’s top three referring social media sources for web traffic were YouTube, Facebook and Reddit. For Lowe’s, it was Facebook, YouTube and Pinterest. Notice the convergence on YouTube? It’s where video and search come to grow!

Building professionals use social media sites too

Recently, Accountability Information Management, Inc. (AIM), a marketing research company, released a study on how much time building professionals spend on social media sites.

The study found that these professionals invest approximately an hour per day on social media, online networks and digital sharing sites for work. During the pandemic, professionals working at home found more time to access social media sites. And they used the networking platforms to communicate with associates, customers and prospects.

“What’s strikingly clear from our data is that social media is capturing more of building professionals time each day,” says Patty Fleider, director of research at AIM. “This research, conducted during the height of the pandemic (January 2021), shows that while the trajectory of social media was on the rise prior to the pandemic, the virus prompted a higher spike than expected.”

Rise of the “social web”

Purchase behavior has changed dramatically in the last 20 years. Shifting brand loyalties and purchaser expectations have been shaped by the social web — also known as the web services, structures and interfaces that support social interactions among humans. And the social web has evolved in response to these changing behaviors and expectations.

Social media use and purchasing behavior ebbs and flows in a yin-yang rhythm of constant change. Ten years ago, social media barely existed. Now ad spending on social sites makes up more than 30 percent of all Internet ad revenue.

Connecting with customers and prospects in the shifting sands of the social media landscape requires vigilance. Different sites attract different people. And every site needs messaging tailored… to both the platform and the audience using that platform.

Brands can’t approach their social media marketing strategy expecting to “set it and forget it.” Why? Because, purchasers are regularly changing which platforms they’re using. How often they use them. And, most importantly… how they rely upon those platforms.

Successful social media strategies need to be agile. Listening and engaging will only grow in critical importance for brand success.

Two-thirds of shoppers do some shopping via social media

In the spring of 2021, the Forbes Agency Council, an invitation-only community for executives in successful public relations, media strategy, creative and advertising agencies, conducted a 6,000-respondent study to get a read on consumer behavior in regard to the social web.

The study found that about two-thirds of shoppers today use social media as part of their shopping strategy. YouTube — as we witnessed in the big box reports this week — is still a primary focus, with half of shoppers saying they turn to content on the platform to research their purchases. Facebook and Instagram follow closely behind. Notably, a third of shoppers rely upon social media influencers to learn about products.

Granted, these are findings about consumers making retail purchases. But your customers carry their B2C behaviors — and expectations — with them when they assume a B2B role while “on the job”. In fact, video content and influencers continue to play a growing role in B2B marketing campaigns.

As “digital natives” move into and up within the organizations your brand markets and sells to… video marketing, influencer programs and social media campaigns will only continue to increase in importance.

So, what does this mean for building product brands?

- It’s crucial to focus a building product brand’s social media presence to ensure you are meeting customers and prospects on the apps and platforms where they are now. Yet, social media strategy must be constantly informed. And nimble enough to keep up with social media trends… to be able to follow audiences where they go next.

- It’s critical to study and understand what product features customers and prospects want to see. Confirming what type of content they’re searching for… and to better serve it to them, in the formats they prefer.

- Content must be easily digestible and sharable so — when your customers want to talk about your products within their social media networks — it’s very easy for them to do so.

Economic and demographic trends point out very clearly that, over time, more of the purchasing process is going to happen on social media and similar platforms. To be successful, building product brands need to implement adaptive, research-driven social media strategies now… to stay ahead of the curve for tomorrow.

Ready to explore how your brand can more effectively navigate in a constantly changing landscape? Drop a line to Steve Kleber at sk@kleberandassociates.com to start a conversation about confirming or establishing 2022 new priorities.