Lennar Corp. – the nation’s second-largest home builder – this week posted net Q2 earnings of $872 million. Its net earnings per share of $2.94 beat Wall Street’s expectations. And total revenues for the quarter were just over $8 billion – topping the consensus estimate by nearly 10.5 percent.

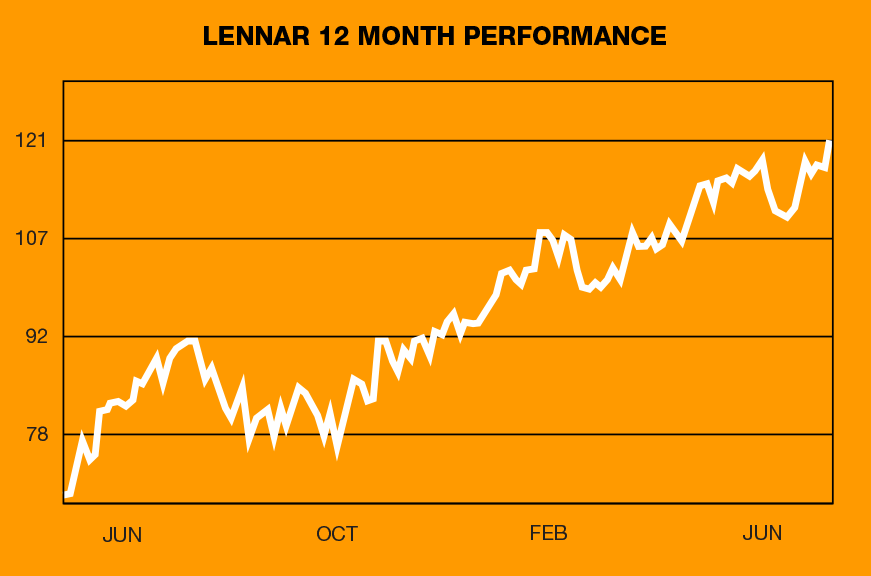

The home builder continues to show momentum, having surpassed consensus earnings per share estimates four times over the last four quarters. It reported deliveries of 17,074 homes – up 3 percent YOY – and new orders for another 17,885 homes with a value of 8.2 billion. Further, Lennar has strengthened its balance sheet, and continues to execute a strategy of downward price adjustments to meet market demand with more affordable homes, aligning well with the realities of this economy.

It’s a snapshot of a bigger economic picture this week that spells good news for the entire building sector:

- The Federal Reserve broke its streak of 10 consecutive rate hikes stretching back to March 2022, and held rates steady.

- The May Consumer Price Index showed overall inflation hitting the lowest mark in more than two years.

- And good news for workers – average hourly earnings rose 0.3 percent in May – outpacing the CPI and giving the average consumer even more buying power.

- What’s more, employers added an unexpectedly high 339,000 jobs in May… marking the 29th straight month of job growth with the unemployment rate hovering near 50-year lows.

- In fact, over the past year, an average of 341,000 jobs have been created each month. Construction grew by 25,000 jobs in May – and over the past 12 months – has added an average of 17,000 workers per month.

- Retail sales, one of the strongest barometers of consumer confidence, also rose 0.3 percent in May from April… exceeding the expectations that there would be a 0.1 percent decline.

Mortgage interest rates eased off their 52-week high of just over 7 percent, with the 30-year fixed rate settling in around 6.7 percent.

The Fed’s decision, along with the positive inflation, jobs and retail sales reports – together with the overall wage increase – are likely to boost consumer sentiment. Which will continue to represent a key factor in home purchasing and remodeling.

Lennar and other national home builders are benefitting from the lack of available existing homes for sale, as housing demand continues to rise. Executive Chairman Stuart Miller explained that the housing market has started to “normalize” after two years of surging home prices, and recover from the Fed’s “aggressive interest rate hikes” throughout 2022. Demand remains robust. “Simply put, America needs more housing,” he said, “particularly affordable workforce housing, and demand is strong when prices and interest rates are affordable.”

Scant inventories of existing homes on the market are largely a function of homeowners – who bought when interest rates were in the 3 to 4 percent range – and who have an unprecedented amount of equity in their homes. Many are opting to stay put and use that equity to repair and renovate. That translates to good news for residential remodelers and suppliers of building materials.

Looking ahead to the third quarter, Lennar expects demand to remain high, as the company prepares to deliver some 18,000 homes. While supply-chain delays have eased and the labor conditions have improved, the company’s production cycle time also shortened… executives believe it will continue to shrink going forward. Miller said from Lennar’s perspective, supply-chain disruptions are in the rear-view mirror, and that the friction taught them to develop more efficient relationships with local suppliers, thus tightening lead time.

What’s Happening With Housing Inflation?

With shelter being the largest component of the CPI and accounting for about a third of CPI weighting, it naturally holds big sway over the direction of overall inflation. After all, it is the largest expense for the average American household. Economists note that because of overheated, pandemic-fueled demand, housing inflation has been running high for months. But many believe it will reverse in the second half of the year.

Realtor.com reported that the national median list price grew to $441,000 in May, up from $430,000 in April. However, it was still down 2 percent from a record high of $449,000 in June 2022. The report said based on current trends, it’s possible that the median listing price won’t hit the previous year’s peak… for the first time since the group began collecting data in 2016. This median list price represented a yearly growth rate of just 0.9 percent. Which is lower than April’s 2.5 percent growth rate… and is the lowest price growth in Realtor.com’s records. Some predictions call for prices to be around 5 percent higher YOY by the end of 2023, which is less than half the pace of the previous year.

The Bottom Line

Many economists expect inflation will continue to ease. Less aggressive pricing, a stabilizing market and lower consumer prices should make new homes, as well as existing homes coming on the market… more accessible for more potential buyers. And as consumers recover from high house prices – and more comfortable with current borrowing rates – they will become more active for home purchasing. And such, driving demand even more.

Looking to the future, Miller said the above factors, in addition to continuing supply constraint, mean builders will need to provide more homes to meet demand.

That’s welcome news for our industry.